Content

When it comes to construction bookkeeping and accounting, it’s important to have a business bank account or credit card and keep it separate from your personal finances. That makes reconciling your transactions much easier and faster because you don’t have to sift through income and expenses unrelated to your construction business. The flow of money in construction companies is tremendously fast and involves a lot of money, not to mention projects are involved hundreds of types of costs. Fortunately, accounting software can help your business eliminate human errors, improve financial management and save you countless hours.

However, because construction accounting is project-centered and production is de-centralized, contractors also need a way to track and report transactions specific to each job. Job costing is the practice in construction accounting of tracking costs to particular projects and production activities. In general, a construction business with gross receipts over $10 million must use the percentage of completion revenue recognition method for tax purposes. A construction business with gross receipts under $10 million can use the completed contract method on construction projects that last less than two years. They’re only required to use the percentage of completion method for construction contracts that extend over two years.

Learn as you grow your construction business

We’ll give you bookkeeping, payroll, reports, and CFO services you and your team need to have an in-depth understanding of the financial performance of your construction business. Our mission is to provide residential and commercial builders and remodelers the precision bookkeeping services they need to aggressively construction bookkeeping grow their construction businesses and their bottom lines. Many contractors wait until a project is complete or almost done to start recording costs or incoming payments. But your books should always have “wet ink” — that is, recently updated figures and details to keep you apprised of what’s really going on.

This will make it easy for you to send invoices online, track expenses, monitor payment status, generate financial reports, and more. Just as you have project managers overseeing each job site, it might make sense to hire a professional accountant to help you reconcile a variety of transactions for various jobs and services. That being said, you can perform the services you need by staying organized and researching some tried and tested methods. If you plan on doing your bookkeeping yourself, here are some of the best bookkeeping construction tips to familiarize yourself with.

MAKE MORE MONEY

Note down all the information from your receipts and invoices in case you ever need it. Here are six aspects of the industry that make effective construction bookkeeping vital. Together, these documents are considered an “application” for payment, because the recipient will have a chance to review the schedule of values and either accept or dispute the billed amount. If they disagree, they’ll send back “redlines” so that the contractor can revise and resubmit the AIA billing application. Billing a fixed-price contract often happens on a percentage-of-completion basis with retainage withheld. You’ll have a precision system to track income and expenses to the project or customer level.

What are the financial statements for construction projects?

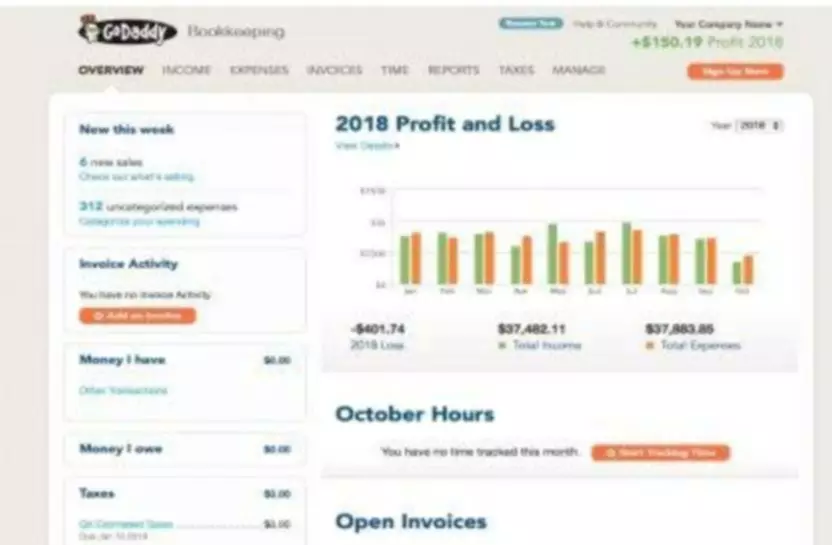

There are four basic reports that make up the core financial statements of a construction company: Balance Sheet, Income Statement (or Profit and Loss Statement), Cash Flow Report, and Work-in-Progress (WIP) report.

Our accounting software also helps map contractor payments to the correct boxes on 1099 forms. To chooses wisely, you need to do some research to assess which one can meet your business’s meets https://www.bookstime.com/ and demands before paying for accounting software. It would not cost you too much but it’s essential to keep your business organized and you can spend more time on revenue-yielding activities.